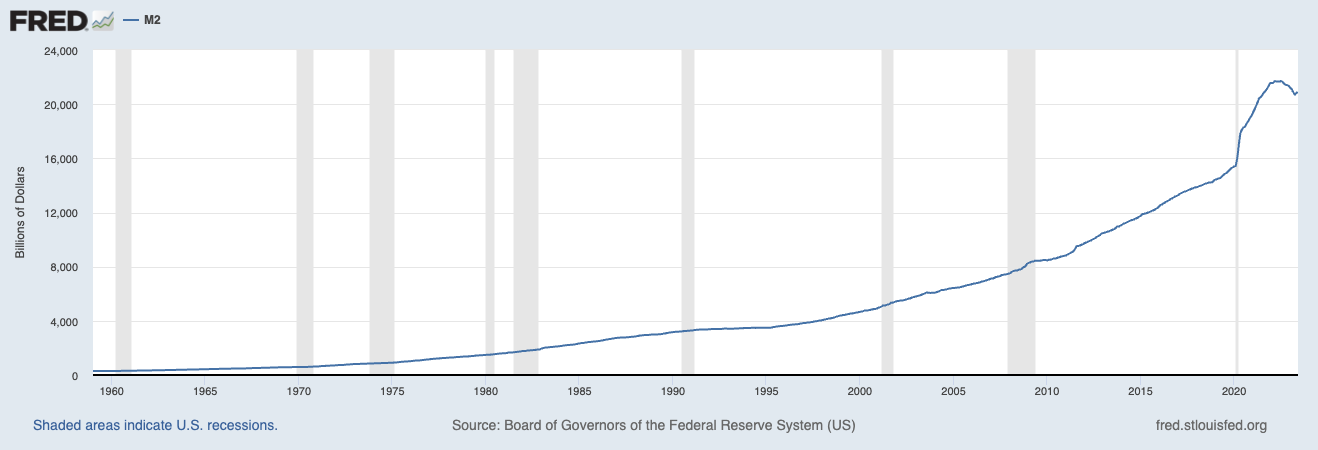

Commercial fractional reserve banks can increase the money supply through creating deposits (dollar IOUs) that are not actually backed by dollar reserves. This is another form of debt and counterfeiting which, along with Federal Reserve money printing, has enabled the astounding growth of US M2 money supply over the last century:

M2 Money Supply

How exactly does the counterfeiting process work? I will discuss that in this blog post.

Reserve Requirements

Reserve requirements are the ratio of dollar deposits that banks must actually back with dollar reserves. I will use a quick toy example to demonstrate how reserve requirements directly influence dollar counterfeiting.

Let's say the reserve requirement is 10%. 10 dollars are deposited into bank A. This means bank A needs to keep 1 of these dollars in reserves, and can loan the other 9 dollars out. Let's say bank A does exactly this, and these 9 dollars are deposited at bank B. Now, there are 19 dollar deposits backed by 10 original dollars:

- 1 backed dollar IOU at bank A

- 9 unbacked dollar IOUs at bank A

- 9 backed dollar IOUs at bank B

As you can see, money has been created! Two people think they collectively have 19 dollars when originally, only 10 dollars were deposited into the bank. Those original 10 dollars are split up as reserves across the two banks, partially backing the 19 dollar IOUs.

This process can continue repeatedly, creating a great deal more dollar IOUs than the original 10 dollars that were deposited. The lower the reserve requirement, the more unbacked dollar IOUs can be created.

Up until quite recently, reserve requirements were 10%. However, in 2020, the Fed reduced reserve requirements to 0 in order to stimulate borrowing. As far as the toy example goes, a 0% reserve requirement would theoretically allow for infinite money creation through infinite lending. However, today there are other restrictions on banks, such as capital requirements, that also affect this calculus.

Capital Requirements

Capital requirements have been a part of the US banking system for decades now. In recent decades, the guidelines for capital requirements have been set by the Basel Accords.

How capital requirements work is that the loans on banks' books are put in different risk categories. Based on the risk category, a bank must keep a certain ratio of "capital" (stock and earnings). From my understanding, shareholder value is thus used to "back up" the loan book which backs the deposits, as opposed to a simpler model of cash being used to back up the deposits in the toy fractional reserve banking scenario. This is possible because the US has "deep capital markets" in which loans can be offloaded into.

Essentially, the Fed is forcing commercial bank shareholders into bailing out losses from the fractional reserve banking model. Before central banking, commercial banks were actually private enterprises and didn't follow the fractional reserve banking model at all. They were essentially just gold counterparties.

Interest Rates

Interest rates are what a lender earns by lending capital to borrowers. In the US, interest rates are set by the Federal Reserve. The official explanation for why the Fed sets interest rates is, "The Fed seeks to set interest rates to help set the backdrop for promoting the conditions that achieve the mandate set by the Congress--namely, maximum sustainable employment, low and stable inflation, and moderate long-term interest rates.". Quite simply, this is a lie. Interest rates set by a central bank are all about printing money for free, getting people in debt, and enslaving people with interest.

Essentially, the Fed sets interest rates (the cheapest cost of capital) and that becomes the baseline "risk-free interest rate". All other interest rates have a spread on this baseline interest rate.

How does the Fed set interest rates?

The Fed sets the baseline interest rate by paying interest rates on capital "lent" to it. This ensures that all other interest rates will be higher than it, because no one would ever lend to a borrower for X% when they can lend to the Fed for Y% where Y > X.

The Fed sets a target for the "federal funds rate", which is the rate that banks lend to each other overnight on an uncollateralized basis.

The way it actually ensures that the market uses this as the baseline rate is, as I said, by actually paying this interest rate on any capital lent to it. There are two tools it uses to do that, which you can read about here. Notice how loans are counted as capital. This is accounting double-counting and is used to inject steady streams of capital into the fractional reserve banking system to keep it running.

The Fed has some other tools to provide capital to the market, such as the discount window. You can check out the discount window here.

Interesting Links

Here is a timeline of Fed monetary policy since 1913, which is when the Fed was first created. A good history lesson.

Khan Academy also seems to have a video series which covers these topics as well as some others. I haven't gone through it myself but for a newcomer, it may be a good starting point.

Conclusions

I realize that this is pretty basic information for anyone who seriously calls themself a central banker. A first week central banking onboarding program would likely go through all this.

That being said, the key plumbing of the system doesn't seem all that complicated. I'm well aware there are many intricacies, terms, and details I'm not aware of, but I believe these are the core components.

I know there's a whole "shadow banking" system out there, as well as a massive derivatives market which is just another form of credit. These are all topics I'd love to learn more about in the future.

As always, let's keep ourselves educated. Knowledge is power. Till next time!