The more I understand Bitcoin, the simpler it becomes for me. Currently, I understand Bitcoin to be digital gold, and competing against physical gold as sound money. Allow me to explain.

Fiat currency and altcoins are scams, not sound money

When people hear that Bitcoin is money, they will typically compare it to fiat currency or various altcoins. However, Bitcoin is not competing against either of these two things because fiat currency and altcoins are both worthless scams.

Fiat currency is not sound money. Specifically, the dollar regressed from gold IOU to unbacked, worthless, toilet-paper fiat currency because greedy bankers wanted to enslave the world through debt and usury.

Altcoins are not sound money. Altcoins are cash-grab Bitcoin-affinity scams without any endgame use case, or at least will go to 0 against Bitcoin as the world converges on Bitcoin as the world's future sound money.

Why is Bitcoin competing with gold?

Bitcoin is competing with gold because historically, gold was used as sound money by humans. In fact, gold has been used as money for 6000 years.

As a short primer, money is a tool that is used as:

- a medium of exchange

- a unit of account

- a store of value

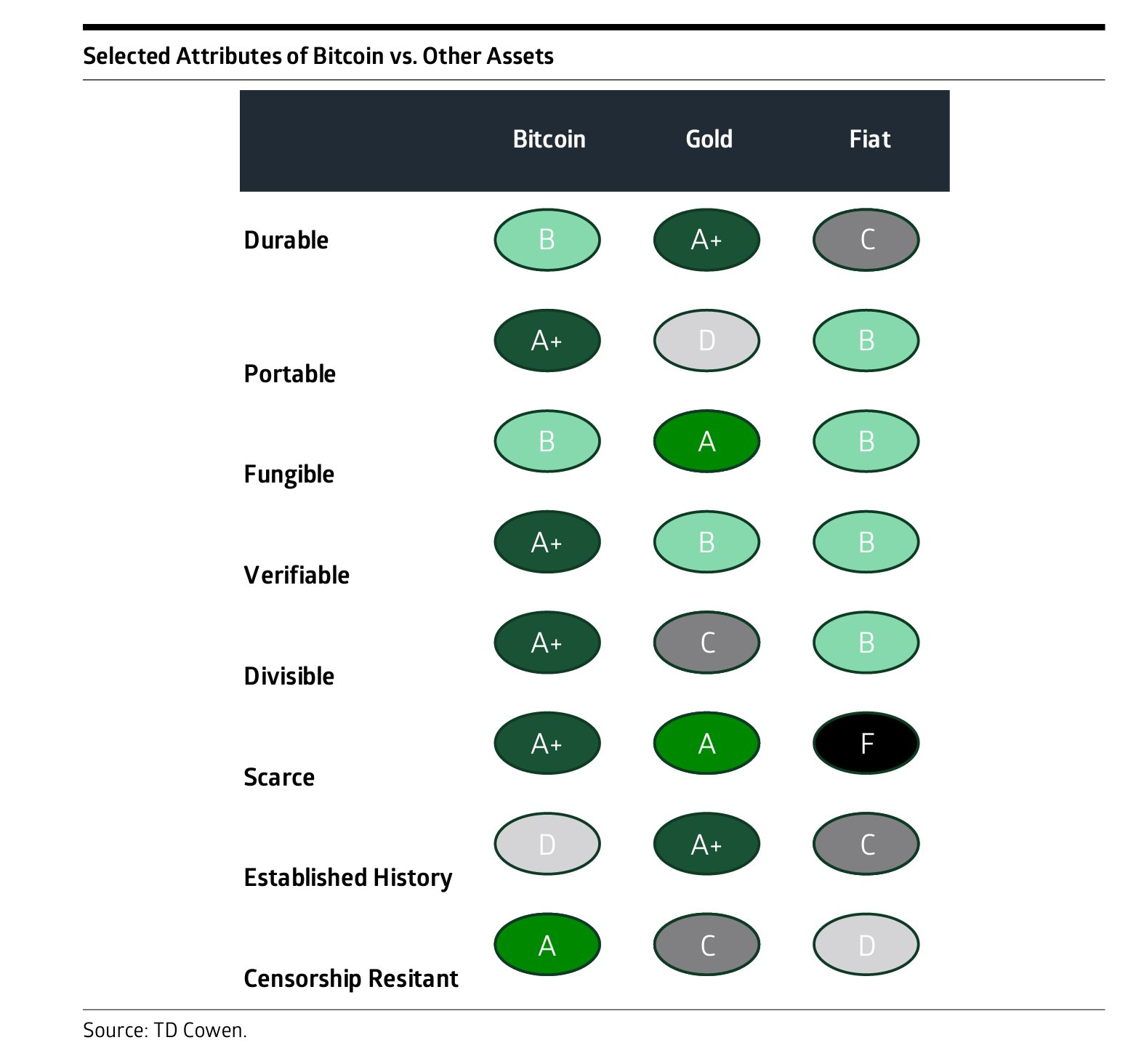

Sound money is money that excels at these use cases. To break it down further, in order for money to excel at these use cases, money should have the following qualities:

- durable

- portable

- fungible

- verifiable

- divisible

- scarce

- censorship resistant

The case for Bitcoin essentially just boils down to the fact that Bitcoin is much better than gold at being sound money because it satisfies the important qualities of money better than gold does. Here's a diagram that analyzes this which came from a private TD Cowen research report on Bitcoin:

Money Comparison

I will leave the task of understanding this scoring to you, the reader.

But I will make a metaphor - going back to gold in today's digital age would be akin to returning to sending physical letters for correspondence instead of using email and messaging apps. For many of the same reasons that email is better than physical mail, Bitcoin is better at being sound money than physical gold.

Gold's Achilles' heel

If fiat's Achilles' heel is its terrible scarcity, gold's Achilles' heel is its low portability and divisibility.

In order to solve this, people have used two solutions:

- minted gold coins of varying denominations, used in conjunctions with coins made of other metals

- stored gold with a counterparty and received a paper gold IOU which can be used as a substitute for physical gold

You can see that both solutions increase or address both the portability and divisibility of gold. However, there are issues with both of these solutions:

- coins can be debased, undergo a lot of wear, and are increasingly difficult to bring around in large quantities

- storing gold with a counterparty has confiscation risk, as well as an issue of reducing the scarcity of money by allowing for counterfeiting, a form of debt

In comparison, Bitcoin is extremely portable, durable, and divisible, and can thus be easily self-custodied without being subject to counterparty risk.

Conclusion

In the same way that the world adopted email as a better form of physical mail, the world is going to adopt Bitcoin as a better form of physical gold. For email, the incentive for adoption was convenience. But for Bitcoin, the incentive is becoming more wealthy, or conversely, not losing all your wealth. Which incentive do you think is more powerful?